THE EXIT PLANNING BLOG

Keep up-to-date with exit planning, succession planning, industry trends, unique specialty insights, and useful content for professional advisors and business owners.

Share this

The Decide Gate of the Value Acceleration Methodology

by Colleen Kowalski on July 28, 2022

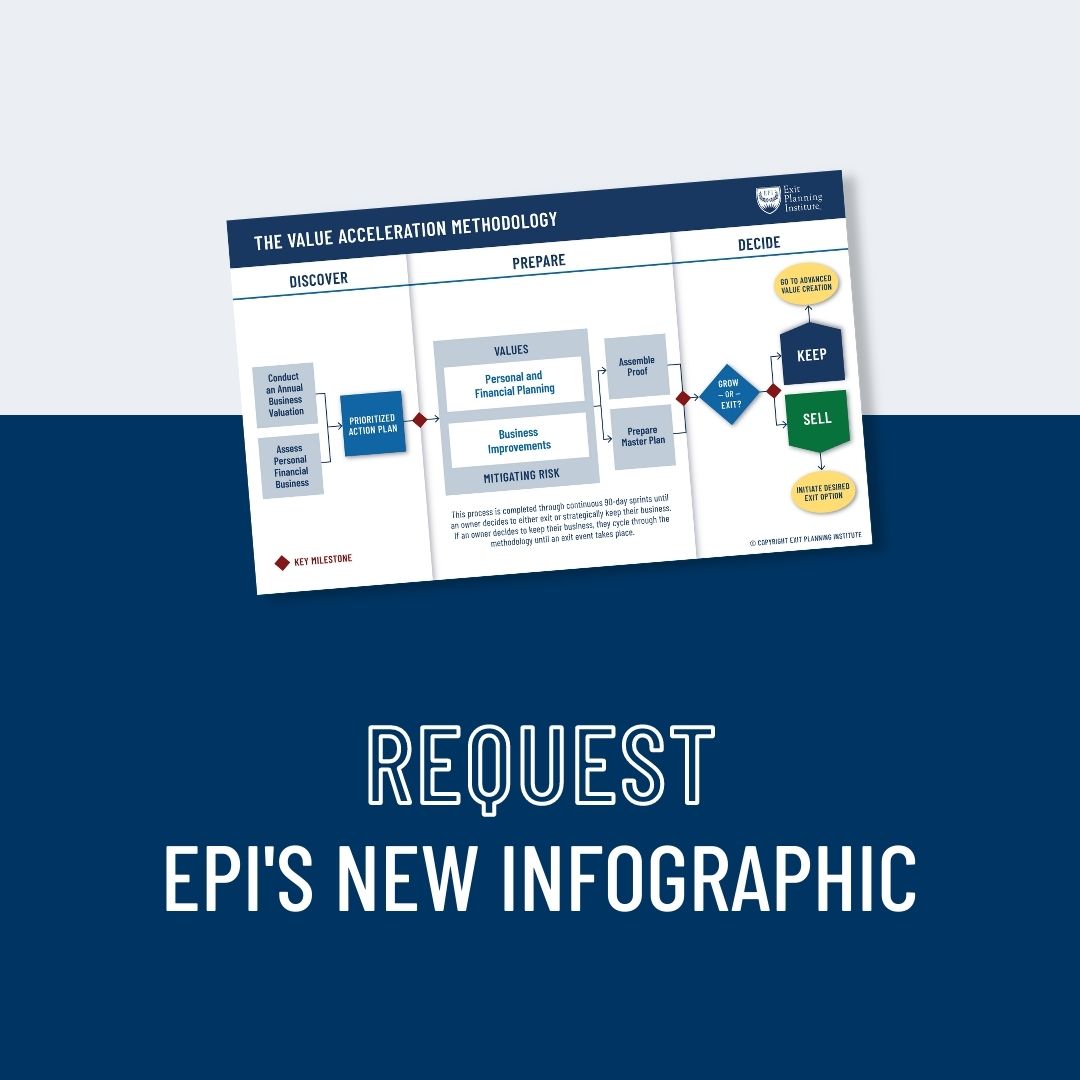

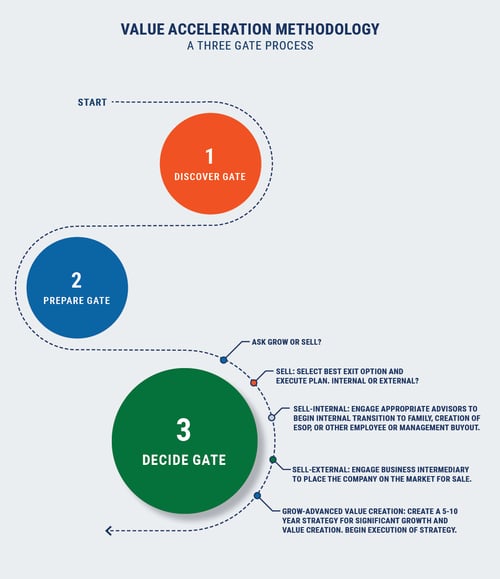

The Value Acceleration Methodology is the backbone of exit planning. This framework focuses on aligning an owner’s business, personal, and financial goals equally. All three elements build upon each other, thus moving us from very successful business owners to very significant business owners.

The Value Acceleration Methodology can be broken down into three gates. These gates are: Discover, Prepare, and Decide. Christopher Snider writes in Walking to Destiny: 11 Actions an Owner Must Take to Rapidly Grow Value & Unlock Wealth, Value Acceleration “can be used as a tool to teach your team how to create value, not just more income, measure their performance, and benchmark value creation.”

Why Use the Value Acceleration Methodology?

To successfully transition their business, an owner must address three things. They must maximize transferable business value, prepare financially for a lifestyle without the income from the business, and plan personally for what they will do in their next act after exiting this business.

The Value Acceleration Methodology combines the plan, concept, effort, and process into a clear strategy to build a business that is both valuable and transferable. Chris Snider shares, “Value acceleration actions require tireless commitment and relentless execution. Exit planning is simply good business strategy integrated with your personal and financial goals and objectives.”

The Decide Gate

The aspect that makes the Value Acceleration Methodology a novel strategy in the exit planning field is the owner’s ability to decide their path. Between the Prepare and Decide gates is a decision diamond that makes a gateway or a path, into the Decide Gate. The question a business owner must ask themselves at that time is, “Do I Keep Growing or Sell?” The owner must ask themselves every 90 days, “Grow or Sell?” If the answer is to grow, then they continue in the Prepare Gate and they continue their 90-day cycles. Every year business advisors conduct a triggering event engagement to understand an owner’s progress. From there they go back into the 90-day sprints.

If the answer is to sell, business owners move into the Decide Gate and get to work in the transition of their company.

The third gate in the methodology is the Decide Gate. It is in this phase of value acceleration that owners decide if they would like to continue growing their business value and stay with the company, or if they are prepared to exit their business with the most wealth.

Rick Feltenberger shares, “The most unique aspect of the Value Acceleration Methodology is that it isn’t software. It is a framework.” This framework can be utilized by those looking to exit their business or those who are only interested in building value in their company.

Do You Want to Grow or Exit?

Justin Goodbread states, “When working through the methodology, business owners are actively working to grow the business’s value. This provides them with an immediate benefit of greater efficiencies, decreased risk, and potential increases in profitability. As well as making the business more attractive to buyers or investors in the future. But once they’ve gone through the Value Acceleration Methodology, they have choices.”

Justin continues, “They could choose to go through the process once again, potentially creating even greater value in their business. A business owner might choose to hold onto the business and enjoy the fruits of their labor. Or they could decide that they’ve increased the value enough to sell it, using the proceeds to fund their retirement or even another business.”

“I Would Like to Exit the Business”

By the time the business owner has reached the Decide Gate and is prepared to exit their business, they will have researched all available exit options.

The most popular internal exit options among business owners, according to our 2021 New York State of Owner Readiness Report are selling to a family member or selling to employees. The most popular external exit options are selling to a third party or to a private equity firm.

Family Transition

41% of owners surveyed for the State of Owner Readiness Report stated they preferred a family transition. Christine Trumbull, Founder of Pinnacle Exit Group, shares that the Value Acceleration Methodology helps eliminate the tensions that can arise during family business succession planning. “If you can eliminate the drama that can come with family succession, you can truly focus on growth and value acceleration. This methodology promotes and somewhat forces open communication, planning, and education.”

The pros to a family succession plan are keeping everything in the family and transitioning the wealth at a lower cost. During a family transition, you can plan for the transition earlier and have more control over your family’s succession than you would if your business and property are sold to a third party. However, when transferring a business to an heir, you typically get a lower sale price and must manage family dynamics that might hinder a sale. While this may be the path of least resistance, it does not necessarily always lead to growth or success.

Sell to Employees – ESOP

According to the National Center for Employee Ownership, as of 2021, there are roughly 6,600 employee stock ownership plans covering more than 14 million participants. According to The ESOP Association, “Employee Stock Ownership Plans (ESOPs) are retirement plans, governed by some of the same laws and regulations as 401(k) plans. ESOPs, though, are fundamentally different from 401(k)s, offering far more advantages to businesses, owners, employees, and communities.”

Keith Apton and Nick Francia, Financial Advisors with UBS Global Wealth Management’s Capital ESOP Group, share, “An ESOP is a flexible and tax-efficient exit strategy for owners of privately-held businesses. Their flexibility comes from the fact that an owner can sell any portion of their stock in the company to the ESOP, from 1% to 100%. A partial sale to an ESOP (selling less than 100% of one’s stock) can allow owners to extract liquidity from the company in the present while retaining a controlling interest and upside potential in the company’s future growth.”

In addition to creating a costless retirement benefit for employees, an ESOP can provide significantly higher returns than other, traditional retirement plan studies. In 2013, the National Center for Employee Ownership (NCEO) released a study showing that ESOP participants had 2.5 times the amount of retirement assets compared to comparable non-ESOP companies.

Sell to Third Party

Selling to a third party is one of the most cost-effective methods of exiting your business. As a business owner, you will be able to walk away faster after the deal and with more cash upfront. Selling to a strategic buyer, financial buyer, or private equity group is also a long process that can take between 9-12 months and involves roughly 1,000 professional hours.

The sale can occur via a negotiated sale, controlled auction, or unsolicited offer. Jessica Ginsberg, Director of Business Development at LFM Capital, shares, “It’s important to remember that business owners often receive unsolicited bids from either strategic or private equity buyers. Being educated on value acceleration issues is invaluable to owners needing to make unexpected decisions. Selling their business is often one of the most important decisions a business owner will make and one that will have lasting effects on family and employees, which in many cases are one and the same.”

The Emotional Impact of Selling

However, this process is more emotional as an owner because you could be selling 100% of your business. This emotional attachment could cause you to be distracted in the process. EPI President, Scott Snider, shares, “This is why a personal plan is so critical. I think it eases the emotional side of things if the business owner has a clear path, goals, purpose, and vision for what is next. A lot of owners bail on the sale of the company right at the end because of “cold feet”. They are scared and to your point emotional. They have let their business be their identity and have done no personal planning. So they bail and keep their company.”

When selling a business to a third-party buyer, business owners will most likely begin working with an intermediary to facilitate the sale. This intermediary could be a Business Broker, Mergers and Acquisitions professional, or an Investment Banker.

Sam Messina highlights the keys to a successful relationship between intermediaries and advisory teams. He shares, “Our internal specialists engage early and often with their CPA to review financials to uncover any holes, gaps, or trouble areas very early on, to address value detractors as well as avoid problems later during the buyer due diligence process or at the closing table.”

Sale to Private Equity Firm

Jessica Ginsberg shares, “A private equity firm is different from a synergistic third party buyer or strategic buyer in the sense that a synergistic buyer is typically an operating company or competitor in the same industry as the seller while a private equity firm is an investment firm. A synergistic or strategic buyer will often acquire a company and merge operations into its larger footprint.”

“I am Going to Keep the Business”

Some business owners go through the Value Acceleration Methodology with the sole purpose of building value in their business, mitigating risks, and creating lasting relationships with customers and employees. When these owners reach the Decide Gate, instead of exiting their business, they decide to grow their business through the process of Advanced Value Acceleration. Some might wish to sell the business, one might want to acquire a competitor, and another owner might like to increase overall sales by 15%.

Chris Snider writes in Walking to Destiny, “In Advanced Value Acceleration, you take on more risk and usually more debt.” It is in Advanced Value Acceleration that owners begin to work on more strategic improvements to their business. This can include hiring key talent, investing in new equipment, expanding into new markets, or acquiring another organization.

Strategic Components to Advanced Value Acceleration

- Hiring Key Talent

- Investing in new equipment

- Expanding a facility

- Re-engineering a manufacturing or distribution process

- Engaging in a longer-term customer service or product initiative

- Diversifying your customer base

- Moving into new markets

- Making and integrating an acquisition

Expand to New Markets

After building value in their business through Value Acceleration, owners might realize their business would serve more than their current market. As a result of going through the Value Acceleration Methodology, owners have a deeper understanding of their business value. Perhaps a business that primarily focused on business-to-business transactions will expand to deliver products directly to the consumer market.

Advance New Products

The resulting value growth from the Value Acceleration Methodology provides owners with the opportunity to invest in product development to expand their brand reach. Jessica Ginsberg shares, “Advisors partner with the management team to identify growth levers, like identifying on add-on acquisitions, increasing efficiency in the facility and introducing new products, and execute on those strategies.”

Growing Through Acquisition

Another option for continued value acceleration is to acquire synergistic companies. Owners may find they are not looking to exit their business but would like to grow by buying out competitors or merging the businesses to grow value. Sam Messina shares that as an investment banker his firm, “Often provides advice and counsel on growth initiatives in order to create the desired outcome for the client. We will provide ongoing advice, typically on a retainer if it is time-intensive or we will provide buy-side services to help the company acquire a strategic business if that is their desire.”

How Do I Incorporate This in My Company?

- Research all Exit Options in advance

- Understand your business value and what multiple you would like in a transaction

- Conduct annual business reviews with key players in the business to clarify the next steps

- Work with a Certified Exit Planning Advisor and a team of advisors to facilitate the sale or growth of your business

Learn more about the Three Gates of the Value Acceleration Methodology in our whitepaper, “From Successful to Significant: The Framework for a High Value Business Transition.”

Share this

- Blog (418)

- CEPA (302)

- exit planning (222)

- CEPA community (167)

- Business Owner (100)

- Exit Planning Summit (72)

- EPI Chapter Network (66)

- Content (48)

- EPI Announcement (46)

- Exit Planning Partner Network (44)

- Value Acceleration Methodology (42)

- Webinars (37)

- Marketing (30)

- 5 Stages of Value Maturity (26)

- 2024 Exit Planning Summit (24)

- Books (24)

- Exit Planning Teams (22)

- 2023 Exit Planning Summit (20)

- EPI Team (19)

- women in business (19)

- Excellence in Exit Planning Awards (18)

- Leadership (17)

- family business (17)

- Black Friday (16)

- Exit Options (16)

- Intangible Capital (16)

- CPA (15)

- EPI Academy (15)

- Chris Snider (13)

- Chapters (12)

- National Accounts (12)

- Small business (12)

- State of Owner Readiness (12)

- charitable intent (12)

- personal planning (12)

- Walking to Destiny (11)

- Financial Advisors (9)

- About us (8)

- Podcast (8)

- 5 Ds (7)

- Insiders Bash (7)

- Case Studies (6)

- Christmas (6)

- Exit Planning Content Library (6)

- Owner Roundtables (5)

- Scott Snider (5)

- Season of Deals (5)

- Value Advisors (5)

- financial planning (5)

- Awards (4)

- Five Ds (4)

- executive training (4)

- Owners Forum (3)

- forbes (3)

- EPI Thought Leadership Council (2)

- Exit & Succession (2)

- Exit Is Now Podcast (2)

- Three Legs of the Stool (2)

- Veteran (2)

- Whitepapers (2)

- Business Owners Forum (1)

- Peter Christman (1)

- author (1)

- business consultants (1)