THE EXIT PLANNING BLOG

Keep up-to-date with exit planning, succession planning, industry trends, unique specialty insights, and useful content for professional advisors and business owners.

Share this

What Skeletons are Lurking in your Closet: How to Identify and Mitigate Risks

by Colleen Kowalski on October 16, 2020

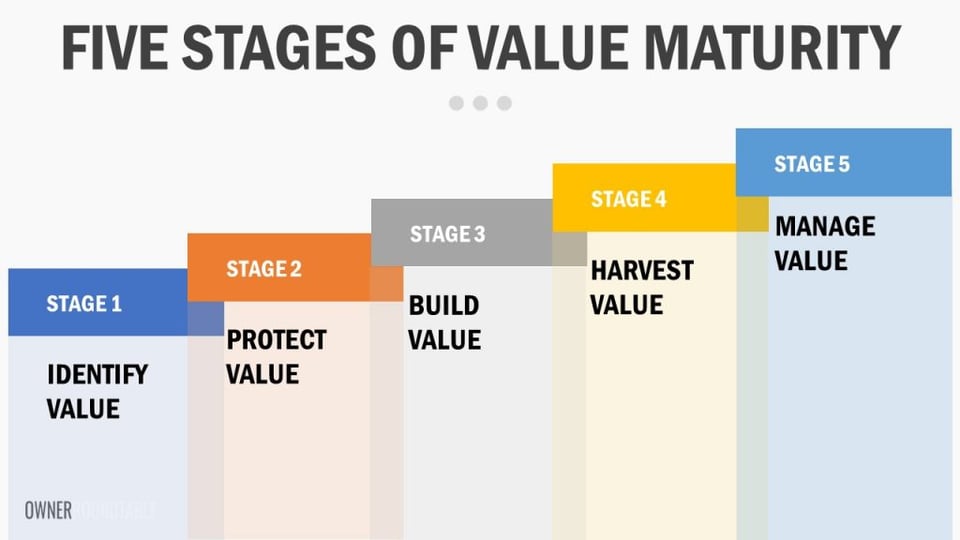

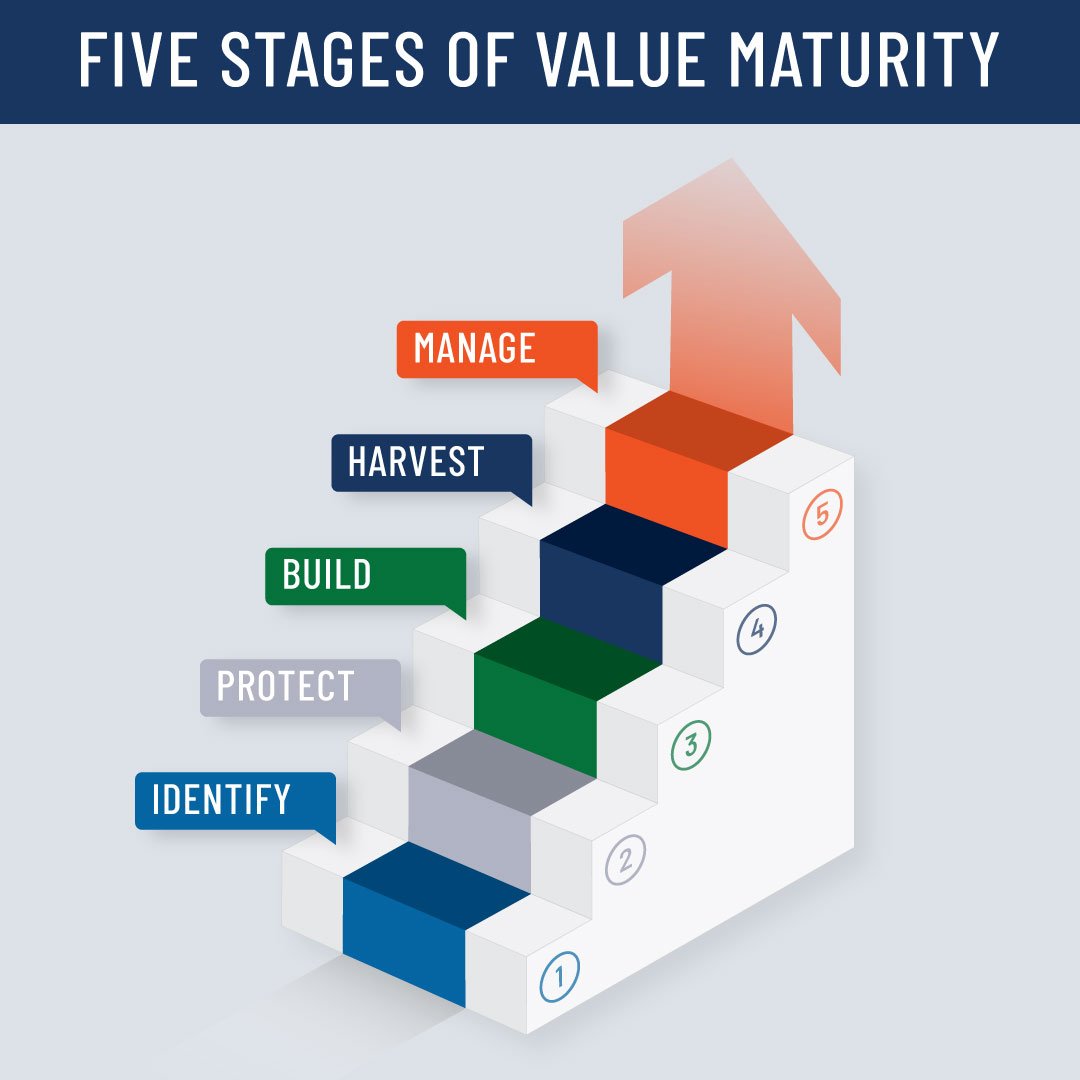

Tis the season for scary movies, haunted houses, and ghost stories. While you could spend the fall watching Hocus Pocus or Halloween, there is something even scarier waiting for you in your business. There are skeletons in your closet. You may know they are there but are too nervous to eradicate them. But more likely, you are none the wiser of the horrors hiding in your business. Owning a business comes with more than its fair share of risks. To increase value and minimize risks in your business, you should follow the 5 Stages of Value Maturity as detailed in Walking To Destiny.

Five Stages of Value Maturity:

Identify:

Roughly 80-90% of your net worth is locked in your business. In order to maximize your value, you need to set up a system to determine value hidden in your business. According to Walking to Destiny, “the ability to unlock that value at some point in the future will make a significant difference to your lifestyle and, at exit, will fund your next act”. It is difficult to plan out your next act without having a professional business valuation. Conducting an annual business valuation will help determine what value factors to focus on to accelerate the value of your business.

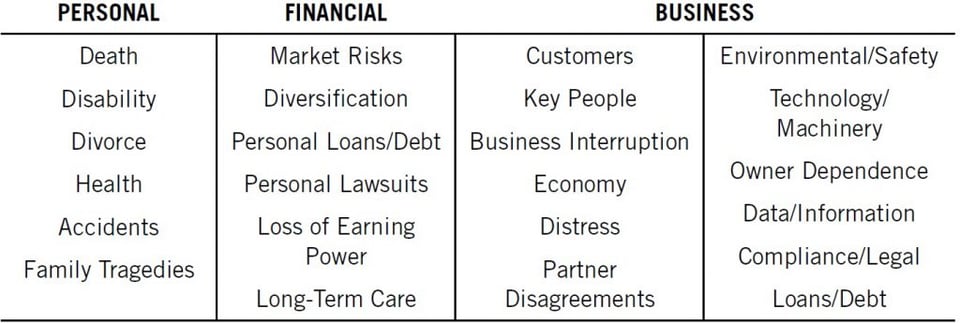

Protect:

After identifying your businesses baseline value, you must protect that value by mitigating any risks associated with it. Risks are divided into three categories: personal, financial, and business. According to Walking to Destiny, “protecting value is the first step in building value”. To best protect your value, you have to consider the Five D’s: Death, Disability, Divorce, Distress, and Disagreement. Even if you do not think you are currently going through one of the Five D’s, without preparing for the worst, your value will be negatively impacted.

Build:

Once you have protected your existing value, your focus can expand to building value. You can build value in two ways: increase tour cash flow (EBITDA) and improve your multiple. Your multiple is the number assigned by the private capital market to the value of your tangible and intangible assets and their associated risks. Intangible assets include: Human, Structural, Customer, and Social Capitals. Improving your intangible assets is critical to building business value.

Harvest:

After building your business value, it is time to harvest that value. There are numerous paths your business exit can take. To get the most value out of your exit, you should invest in an investment banker and business advisor. You might discover that after reviewing your options, you decide not to sell your business and might instead transition the company to a son or daughter, sell the real estate and keep the company, or continue to build value.

Manage:

You manage value throughout the course of your business lifecycle, but the most important time to manage your value is after exiting your business. To achieve the most value, you have to manage not only your business value but your personal and personal financial value as well.

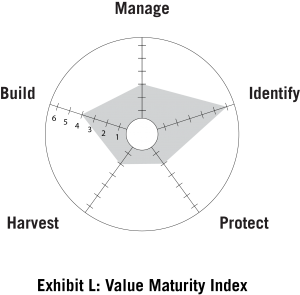

Value Maturity Index:

Learn where you score in each of the five segments of the value maturity by completing the Value Maturity Index. Give yourself a score of six if you have fully fulfilled everything in a category and a score of one if you have done nothing at all in the segment. Draw a line connecting each segment and shade in the area. The nonshaded area represents your area for improvement. This simple index should be completed every 90 days to highlight how your value has grown.

While skeletons are festive Halloween décor, limiting the number of skeletons hiding in your business will provide you with the best value during the exit planning process. Going through the Five Stages of Value Maturity and utilizing the Value Maturity Index will eliminate these skeletons.

Learn more about the Value Maturity Index in our CEPA Program.

Share this

- Blog (418)

- CEPA (302)

- exit planning (222)

- CEPA community (167)

- Business Owner (100)

- Exit Planning Summit (72)

- EPI Chapter Network (66)

- Content (48)

- EPI Announcement (46)

- Exit Planning Partner Network (44)

- Value Acceleration Methodology (42)

- Webinars (37)

- Marketing (30)

- 5 Stages of Value Maturity (26)

- Books (24)

- 2024 Exit Planning Summit (22)

- Exit Planning Teams (22)

- 2023 Exit Planning Summit (20)

- EPI Team (19)

- women in business (19)

- Leadership (17)

- family business (17)

- Black Friday (16)

- Excellence in Exit Planning Awards (16)

- Exit Options (16)

- Intangible Capital (16)

- CPA (15)

- EPI Academy (15)

- Chris Snider (13)

- Chapters (12)

- National Accounts (12)

- Small business (12)

- State of Owner Readiness (12)

- charitable intent (12)

- personal planning (12)

- Walking to Destiny (11)

- Financial Advisors (9)

- About us (8)

- Podcast (8)

- 5 Ds (7)

- Insiders Bash (7)

- Case Studies (6)

- Christmas (6)

- Exit Planning Content Library (6)

- Owner Roundtables (5)

- Scott Snider (5)

- Season of Deals (5)

- Value Advisors (5)

- financial planning (5)

- Awards (4)

- Five Ds (4)

- executive training (4)

- Owners Forum (3)

- forbes (3)

- EPI Thought Leadership Council (2)

- Exit & Succession (2)

- Exit Is Now Podcast (2)

- Three Legs of the Stool (2)

- Veteran (2)

- Whitepapers (2)

- Business Owners Forum (1)

- Peter Christman (1)

- author (1)

- business consultants (1)