ONLINE EDUCATION OPTIONS

The Exit Planning Institute (EPI) offers an opportunity to enhance your knowledge of exit planning while earning continuing education credits through our virtual webinars. These online sessions feature engaging and informative content presented by various experts in the field.

Note: Webinar recordings are available after broadcast to members of our CEPA® Credentialed Plus tier. These sessions support ongoing professional development and serve as a valuable reference for advisors. Recordings can be accessed by logging into the Member Center.

Continuing Education: Current CEPAs who attend an EPI Webinar will earn 1 EPI CE Credit for attending the live session. The CE Credit from attending will be added to your CE Tracker within five business days. Sessions attended by phone cannot be automatically tracked, so members should self-submit these sessions to receive CE Credit.

Upcoming Webinars

2026 State of the Institute Address

The 2026 State of the Institute Address provides a clear look at where the Exit Planning Institute® is headed and how that direction supports you as a CEPA® and advisor. In this annual address, EPI President Scott Snider will share the strategic priorities, new initiatives, and key investments shaping 2026, all grounded in the Value Acceleration Methodology™.

Become a Business Owner Specialist

Are you ready to attract more business owner clients, grow your AUM, and stand out as a true expert in the market? You might have earned your CEPA designation — now it's time to unlock its full potential. Hear from Jeff Armstrong from Culivate Advisors for this insightful session.

Exit Readiness Challenges in Certified Contract-Based Businesses

In this session, Meredith Moore, CEPA, Founder and CEO of Artisan Financial Strategies, explores how ownership, control, contract dependency, liquidity, and succession issues uniquely affect certified businesses, and why traditional exit planning frameworks often need to be adapted to protect long-term value.

Moving from Strategy Through Growth in the Value Acceleration Methodology

Join Greg Fisher of Accelerate Business Development Services, LLC for a powerful webinar session where we will outline a process and tools to help owners address the organizational, market, technical and executional uncertainties of growth initiatives, from buy versus make decisions through vertical integration.

Structured Installment Sales: Unlocking Tax-Deferred Wealth for Your Exiting Business Owner Clients

Join Dan Finn for an essential webinar exploring Structured Installment Sales—a powerful strategy that can transform how your clients exit their businesses. As an exit planning advisor, you know that business sales often trigger devastating tax consequences that can erode 30-40% of your client's life's work.

.png)

Know Your Number: Using Scenario Analysis to Exit on Your Terms

This special edition webinar is presented by Joe Seetoo, 2025 Exit Planner of the Year. In this session, we will review a real client case using eMoney financial planning software to demonstrate how scenario analysis helps owners prepare for an exit.

Inside the Exit Planning Summit’s Advanced Workshops

This webinar presented by Ryan Beltz takes a closer look at the Exit Planning Summit’s advanced workshops and the experts leading them, focusing on how each experience supports advisors in real client work. You’ll gain clarity on the purpose, format, and practical takeaways of each workshop, along with how the content is applied in real-world exit planning scenarios.

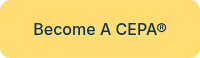

The Missing Link in Exit Planning: Protecting and Funding the Business Through Strategic Insurance Solutions

In this session, Dianne Kelley, CEPA, founder of FreshVue Business Solutions and Sandbrook Group, explores the essential role of insurance in exit planning. You’ll learn how life insurance, key person policies, buy-sell funding, disability protection, and business overhead coverage safeguard enterprise value, protect ownership continuity, and ensure financial stability. Equip yourself to identify coverage gaps and collaborate effectively with insurance professionals to create resilient, value-driven exit plans for your clients.

The 5 Secrets to Getting Found Online — and how AI can solve that for you

Join Darin Adams of Thryv where you’ll uncover the 5 secrets to getting found online and learn how AI can make improving your visibility simple and sustainable. Discover how to strengthen your Google presence, stand out with credibility, and ensure clients and referral partners can easily find and trust your expertise.

M&A Ready: Your 24-Month Exit Playbook

This session presented by Josh Bass is for founders and owners who see a potential sale on the horizon and want to control the outcome, not just react to it. Over 24 months, the right preparation can add meaningful value to your business, reduce deal risk, and expand your pool of serious buyers.

Two Sides of the Exit Multiplier: Increasing Business Valuation Today, Strengthening Family Wealth Tomorrow

Leslie Hurm with Breakwater Accounting & Advisory will examine how financial execution functions as an “exit multiplier.” Reliable financial data enables owners to shift from day-to-day operators to strategic decision-makers who understand how value is created, measured, and preserved. When books are clean, consistently maintained, and aligned with how the business actually operates, owners gain clarity earlier in the process. That clarity leads to better decisions around timing, structure, reinvestment, and risk. It also reduces the likelihood that surprises emerge during diligence, when leverage is lowest and costs are highest.

.png)

ESOPs with Eyes Wide Open

Knowing the advantages and limitations of an employee ownership sale can mean the difference between a smooth succession plan and unintended consequences. Join award-winning ESOP advisor David Blauzvern as he explains the pros, cons, and candid truths of employee ownership strategies. He’ll draw clear comparisons with other transaction options and take your questions.

Become the Go-To Advisor for Exit-Planning Conversation

Exit planning is a high-trust, high-stakes conversation—and the advisors who win it aren't just the most qualified. They're the ones who are most visible, most memorable, and most clearly positioned as the trusted guide for business owners. In this session, you'll learn how a short, focused book can become your most powerful business development asset as a CEPA—one that opens doors to media exposure and podcast interviews, makes every marketing dollar you spend work harder, and positions you as the obvious choice before you ever walk into the room.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Insider's Look at the 2026 Exit Planning Summit

In this webinar, Scott Snider will break down the Exit Planning Summit schedule, share highlights from can’t-miss sessions, spotlight this year’s workshops and provide tips to help you get the most out of your time onsite. Whether it’s your first time attending or you’re a returning Exit Planning Summit veteran, this session ensures you’re ready to hit the ground running!

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

.png)

How To Thrive In The “Trust Recession” with Trust-Based Selling & The One Call Sale

Hear from Ari Galper on what he calls the Trust Recession. Many advisors find themselves giving away their expertise through free consulting, investing more time educating and following up, with less momentum than ever before.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

.png)

ESOP Financing – Why it Matters and How it’s Secured

This session presented by Andrew Nikolai is designed for exit planning advisors with a basic understanding of employee stock ownership plans, but limited exposure to the transaction process. To learn more about ESOP-led business succession and exit strategies

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

.png)

Designing an Optimal Business Transition Strategy

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.

Save the Date - 2026 EPI Webinar

Join the Exit Planning Institute for our 2026 Webinar Series! Current CEPAs can earn 1 EPI CE Credit for attending live sessions. CE Credits will be added to your CE Tracker within five business days after participation. Please note: Attendance via phone cannot be automatically tracked, so members must self-submit these sessions to receive credit.