BRIAN KERR

Brian Kerr is a Partner of Prolign Capital. Mr. Kerr has spent over 25 years working with lower middle market corporations and entrepreneurs on financial and strategic projects, including balance sheet recapitalizations, debt and equity alternatives, leveraged buyouts, and mergers and acquisitions. Prior to joining PES, the predecessor of Prolign, in 2015, Mr. Kerr was the founder of Clairemont Capital Group, a lower middle market private investment firm. Before forming Clairemont Capital Group, Mr. Kerr was a Managing Director at Cornerstone Capital Holdings and Penn Mezzanine. At both Cornerstone and Penn Mezzanine, Mr. Kerr was responsible for sourcing, evaluating and underwriting investment opportunities, as well as portfolio company management. Mr. Kerr started his career as an investment banker advising private and public companies on M&A, private placement and equity and equity-linked transactions.

Mr. Kerr received a BS in Economics from Lehigh University and MBA from The Fuqua School of Business at Duke University.

Brian Kerr is a Partner of Prolign Capital. Mr. Kerr has spent over 25 years working with lower middle market corporations and entrepreneurs on financial and strategic projects, including balance sheet recapitalizations, debt and equity alternatives, leveraged buyouts, and mergers and acquisitions. Prior to joining PES, the predecessor of Prolign, in 2015, Mr. Kerr was the founder of Clairemont Capital Group, a lower middle market private investment firm. Before forming Clairemont Capital Group, Mr. Kerr was a Managing Director at Cornerstone Capital Holdings and Penn Mezzanine. At both Cornerstone and Penn Mezzanine, Mr. Kerr was responsible for sourcing, evaluating and underwriting investment opportunities, as well as portfolio company management. Mr. Kerr started his career as an investment banker advising private and public companies on M&A, private placement and equity and equity-linked transactions.

Mr. Kerr received a BS in Economics from Lehigh University and MBA from The Fuqua School of Business at Duke University.

, hs_object_source_label=CRM_UI, url_slug=Brian-Kerr, profile_image=https://6863690.fs1.hubspotusercontent-na1.net/hubfs/6863690/briankerr.png, lname=Kerr, hubspot_owner_id=1855157339, hs_object_source_id=userId:67963776, hs_created_by_user_id=67963776, hs_createdate=1736438385851, cohortium_profile_title=Brian Kerr | undefined at Prolign Capital | CEPA Connect Member, id=22293567626, job_title=Partner, custom_page_title=Brian Kerr, cohortium_meta_description=Connect with Brian Kerr working with Prolign Capital., hs_user_ids_of_all_owners=[67963776], hs_all_assigned_business_unit_ids=[0], url_slug_2=Brian-Kerr, impersonate_user_url=https://exit-planning-institute.org/member-detail/Brian-Kerr?impersonation=true, full_name=Brian Kerr, hs_lastmodifieddate=1764948262061, hubspot_owner_assigneddate=1736438385851, company_name=Prolign Capital, name=Brian, hs_object_id=22293567626, associated_resources=0, hs_object_source=CRM_UI, hs_object_source_user_id=67963776, hs_updated_by_user_id=67963776}- Advisor Type:

- Website:

https:// - Phone:

- City:

- State:

- Postal Code:

- Country:

- Designations:

- Markets Served:

- Company Name: Prolign Capital

BRIAN KERR

120-Day CEPA Playbook: Download the Playbook

2022 Colorado State of Owner Readiness Quick Look Brochure

2022 Colorado State of Owner Readiness Report

2023 National State of Owner Readiness Report

.png)

2024 Webinar Series

2025 Webinar Series

.png)

2026 Webinar Series

5-4-3-2-1 Whitepaper

5-4-3-2-1 Whitepaper

A Look Inside The Unique World of - Value Creation Whitepaper

A Look Into Pressure Solutions Inc.: An Exit Planning Case Study

Access My Courses

Best-In-Class Whitepaper

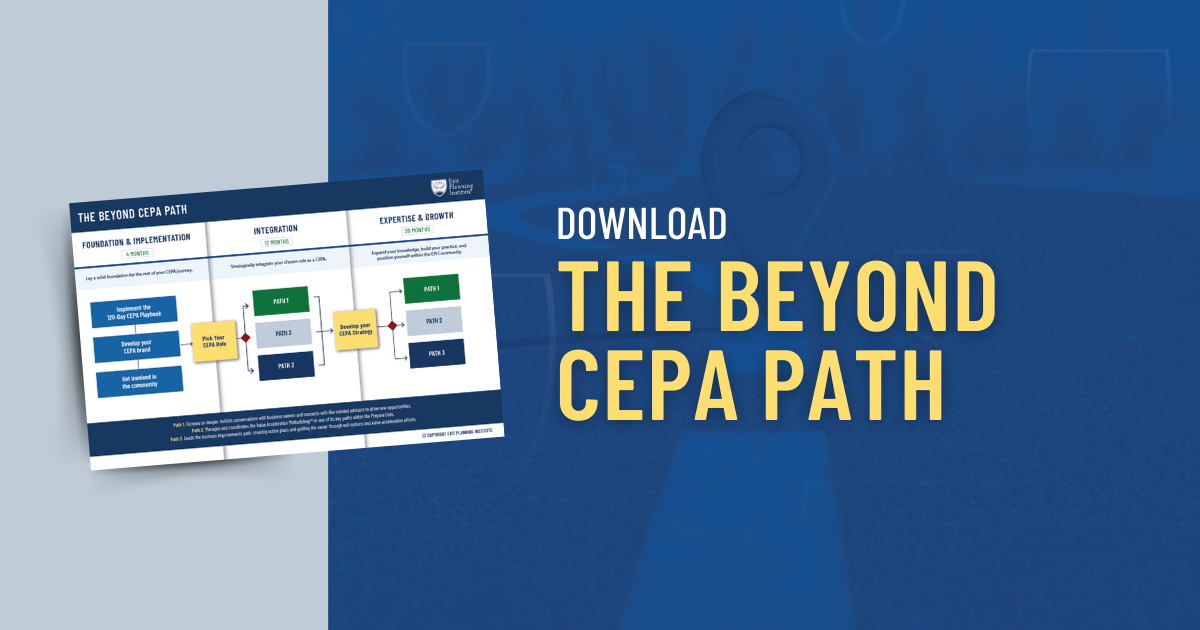

Beyond CEPA Roadmap

Business Attractiveness Scorecard

Case Study: A Framework To Build Value In Your Business

Case Study: CEPA and CPAs

Case Study: CEPA and EOS

Case Study: CEPA and M&A

Case Study: How to Strategically Build Transferrable Value

Case Study: How To Utilize Your CEPA Credentials In A National Wealth Management Firm

Case Study: Human Capital, The Exit Planning Institute

Case Study: The Value of Transitioning a Business to its Employees

Case Study: The Value of Transitioning a Business to its Employees

Case Study: Value Acceleration

CEPA Development Scorecard

CEPA: 2024 APR | Online

CEPA: 2024 AUG | Online

CEPA: 2024 FEB | Online

CEPA: 2024 JAN | Online

CEPA: 2024 JUL | Online

CEPA: 2024 JUN | Online

CEPA: 2024 MAR | Online

CEPA: 2024 MAY | Online

CEPA: 2024 OCT | Online

CEPA: 2024 SEP | Online

Chapter Logos

Confidential Estate Planning Form

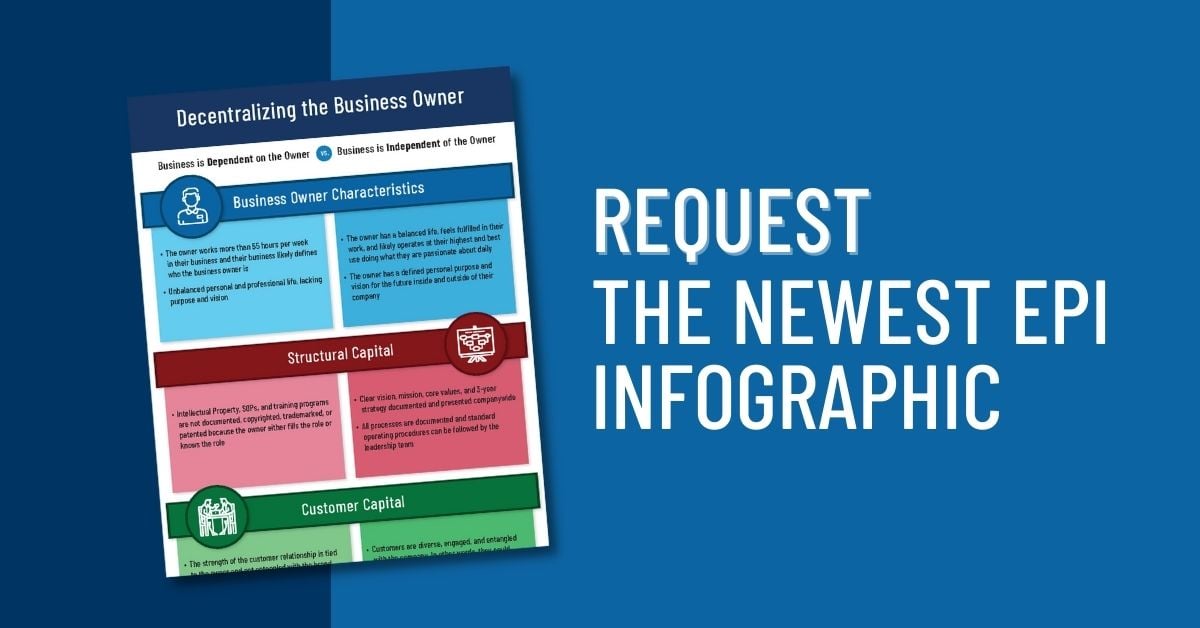

Decentralizing the Business Owner

Decentralizing the Business Owner

Email Marketing Templates

EPI Chapter President Circle Meeting Notes

Exit as a Business Strategy: A Collection of Case Studies from Advisors and Owners

First Steps

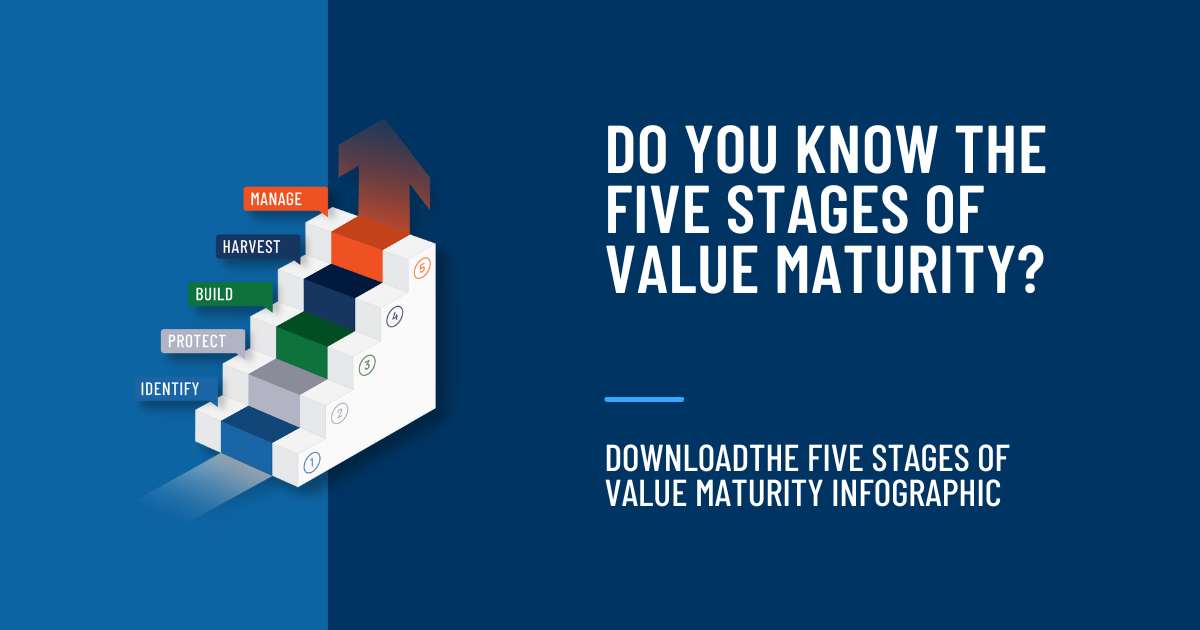

Five Stages of Value Maturity Infographic

Five Stages of Value Maturity Infographic

From Successful to Significant

From Successful to Significant Whitepaper

Infographic: Beyond CEPA Path

Infographic: Decentralizing the Business Owner

Infographic: Five Stages of Value Maturity

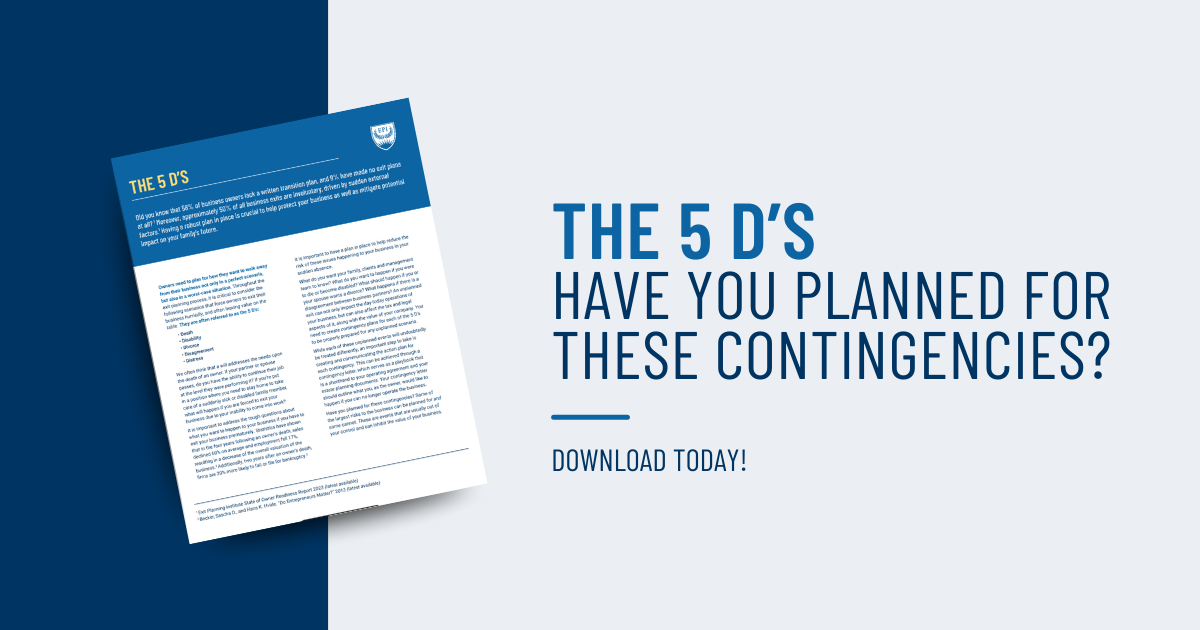

Infographic: The 5 D's

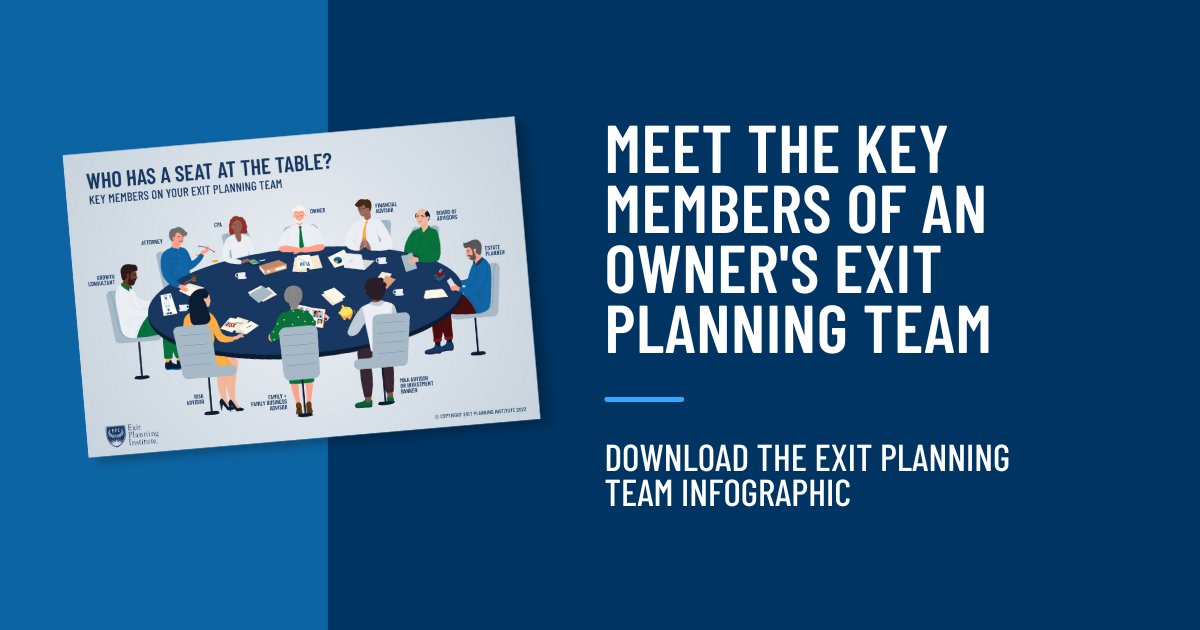

Infographic: Who Has a Seat at the Table

Issue One: The Annual Exit Magazine

Know Your Gaps

Phase 1 Stage 1: The Value Maturity Index - Identifying Value

Sample Personal Contingency Plan

The Impact of Unplanned Consequences on Business Value Whitepaper

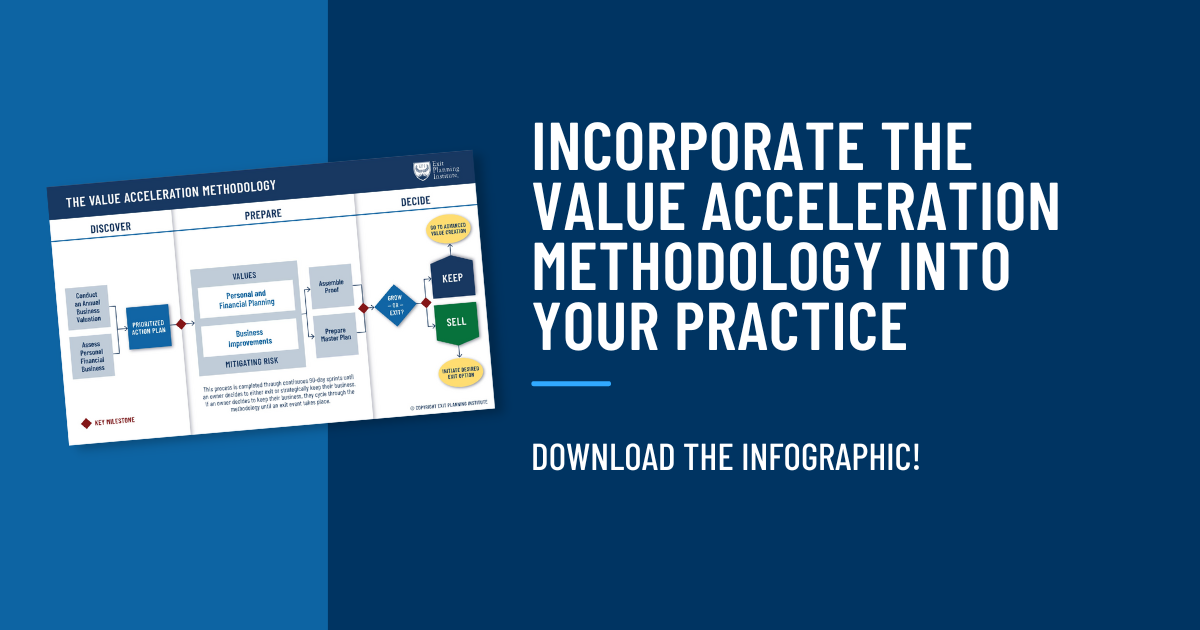

The Value Acceleration Methodology

.png)